It is the first part of February so that means it is time for myself and most people to start working on their taxes. Although I tend to find myself procrastinating on a lot of things throughout the year my taxes are not one of them.

It is the first part of February so that means it is time for myself and most people to start working on their taxes. Although I tend to find myself procrastinating on a lot of things throughout the year my taxes are not one of them.

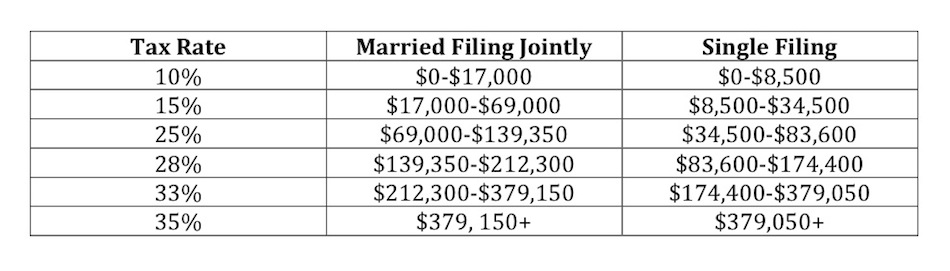

Before you begin doing all of the work whether you are doing them yourself or you hire a tax professional you need to have an understanding of tax brackets and a couple basic tax terms.

Federal tax brackets have been around since 1913 but they have changed more than a few times over the past 99 years. As part of the Revenue act of 1913 income was taxed between 1% and 7% depending on your income. Over the course of years the top rate has risen as high as 94% in 1945. The current tax brackets have remained the same now since 2003.

One thing I always suggest doing towards the end of the year is figure out what your income bracket will be for that tax year. By knowing this you can make a lot of year end tax decisions.

Now a few common terms that you should know to better understand how much money you are paying Uncle Sam. First is Marginal Tax rate. This is the percentage that is displayed in the table above. You need to keep in mind that this is not the rate that all of your income is taxed. Lets say for example that you are married filing jointly and you earned $75,000 in 2011. You will only pay 25% on the portion of income over $69,000.

The last big term that you need to be familiar with is your effective tax rate. This is calculated by dividing your total tax by your taxable income. Because the US operates on a progressive rate system our effective rate will almost always be lower than our marginal rate.

By knowing the information about you will have a better idea of where you stand for that year. If you are right on the edge of moving into the next tax bracket it’s good to know because you could defer some income to the following year or give a little bit more to charity.