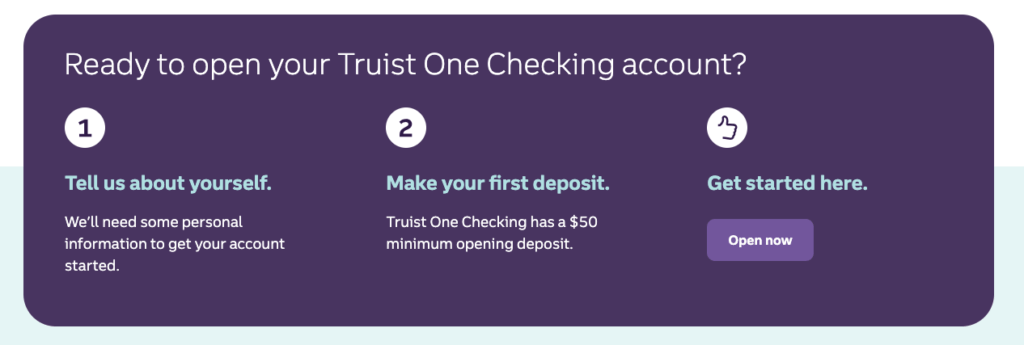

You can open a new Truist One Checking account through April 30, 2025, and receive a $400 cash bonus. This is one of the best Truist bank bonuses we’ve seen recently. In the past, there were offers for $100 and even up to $300, but now, they’re making it even more attractive to sign up for a new account.

To earn your bonus, you’ll need to complete the following requirements.

- Open a new Truist One checking account online or in a branch location and use Truist promo code DC2425TR1400.

- Complete two qualifying direct deposits totaling $1,000 or more within 120 days of account opening.

Once you’ve completed the requirements, your bonus will be deposited into your new checking account within four weeks.

Truist One Checking Account Features

The Truist One Checking account comes with many useful features.

No Overdraft Fees

With a Truist One account, there are no overdraft fees. Plus, they provide eligible customers with a $100 Negative Balance Buffer.

Negative Balance Buffer Eligibility Requirements

- Account must be opened for a minimum of 35 days

- Account must have a positive balance

- Direct deposit of at least $100 per month must be made for two consecutive months

To remain eligible for the Negative Balance Buffer, you must continue to receive a direct deposit of at least $100 each month.

Five Levels of Perks

The perks you’ll receive with your Truist One checking account will depend on your reward level. These levels are determined by the combined monthly average balance in all Truist accounts.

Level 1: $0 – $9,999.99

- 10% loyalty bonus on eligible credit cards

- Free 10-pack of checks (first order only)

- Delta SkyMiles® Debit Card (optional perk with a $95 annual fee)

- Truist One Savings account with no monthly maintenance fee

Level 2: $10,000 – $24,999.99

- 20% loyalty bonus on eligible credit cards

- Free 10-pack of checks and 50% off all reorders

- Delta SkyMiles® Debit Card (optional perk with a $95 annual fee)

- Truist One Savings account with no monthly maintenance fee

- One no-fee non-Truist ATM transaction per month

- One additional Truist One Checking account with no monthly maintenance fee

Level 3: $25,000 – $49,999.99

- 30% loyalty bonus on eligible credit cards

- Free 10-pack of checks and free reorders

- Delta SkyMiles® Debit Card (optional perk with a $75 annual fee)

- Truist One Savings account with no monthly maintenance fee

- Three no-fee non-Truist ATM transaction per month

- Two additional Truist One Checking account with no monthly maintenance fee

Level 4: $50,000 – $99,999.99

- 40% loyalty bonus on eligible credit cards

- Free 10-pack of checks and free reorders

- Delta SkyMiles® Debit Card (optional perk with a $75 annual fee)

- Truist One Savings account with no monthly maintenance fee

- Five no-fee non-Truist ATM transaction per month

- Three additional Truist One Checking account with no monthly maintenance fee

Level Premier: $100,000 or more

- 50% loyalty bonus on eligible credit cards

- Free 10-pack of checks and free reorders

- Delta SkyMiles® Debit Card (optional perk with a $25 annual fee)

- Truist One Savings account with no monthly maintenance fee

- Unlimited no-fee non-Truist ATM transaction per month

- Unlimited additional Truist One Checking account with no monthly maintenance fee

Monthly Maintenance Fee

The Truist One checking account comes with a $12 monthly maintenance fee. However, you can have this fee waived with any of the following:

- Make $500 or more in qualifying direct deposits during a statement cycle

- Maintain a $500 monthly combined balance between all Truist accounts

- Have a personal Truist credit card, mortgage, or consumer loan (this does not include LightStream®)

- Link a Truist business checking account

- You’re a student under the age of 25

Additional Requirements

- You must be 18 years or older to open an account and earn a Truist checking account bonus.

- Qualifying direct deposits include electronic deposits of your employment salary, pension check, or Social Security check.

- Truist checking accounts are only available to those with a mailing address in the following states. AL, AR, GA, FL, IN, KY, MD, MS, NC, NJ, OH, PA, SC, TN, TX, VA, WV or DC.

- The Truist $400 checking bonus is unavailable to anyone who’s had or closed a Truist One account since October 31, 2023.

About Truist Bank

The bank was created in December 2019 when BB&T and SunTrust joined forces in one of the biggest bank mergers in U.S. history. The idea was to build something modern and tech-savvy while keeping the friendly, personal touch both banks were known for.

Based in Charlotte, North Carolina, Truist has over 2,000 branches in the Southeastern and Mid-Atlantic U.S. It’s one of the country’s top 10 largest banks, with over $500 billion in assets.

Truist Bank has focused on giving back to communities through the Truist Foundation and local partnerships. It is also rolling out digital tools to make banking easier and more convenient for its customers.

How Does This Truist Personal Checking Offer Compare?

Want to see how this Truist Bank checking offer compares? Here are a few other checking account bonuses that are available.

U.S Bank Smartly® Checking

Earn up to a $450 cash bonus when you complete qualifying activities.

Capital One 360 Checking Account

Earn a $250 bonus when you open a Capital One 360 Checking account and set up qualifying direct deposits.

Discover Cashback Checking

Earn up to $360 ($30 per month) with the Discover Cashback Checking account.