There was a time when I thought keeping accurate track of my net worth would be a daunting task. I figured that I would have to do research each month to figure out the value of what I owned, and how much my savings account was worth, and just where I stood with my investments. However, about two years ago my wife and I needed to get a new (to us) car, and I decided to figure out how it would affect our finances. I sat down at my computer for a little while and created a simple spreadsheet. Once created, I can keep track of my net worth with about 5 minutes of “research” each month. Here is how I do it.

The Spreadsheet

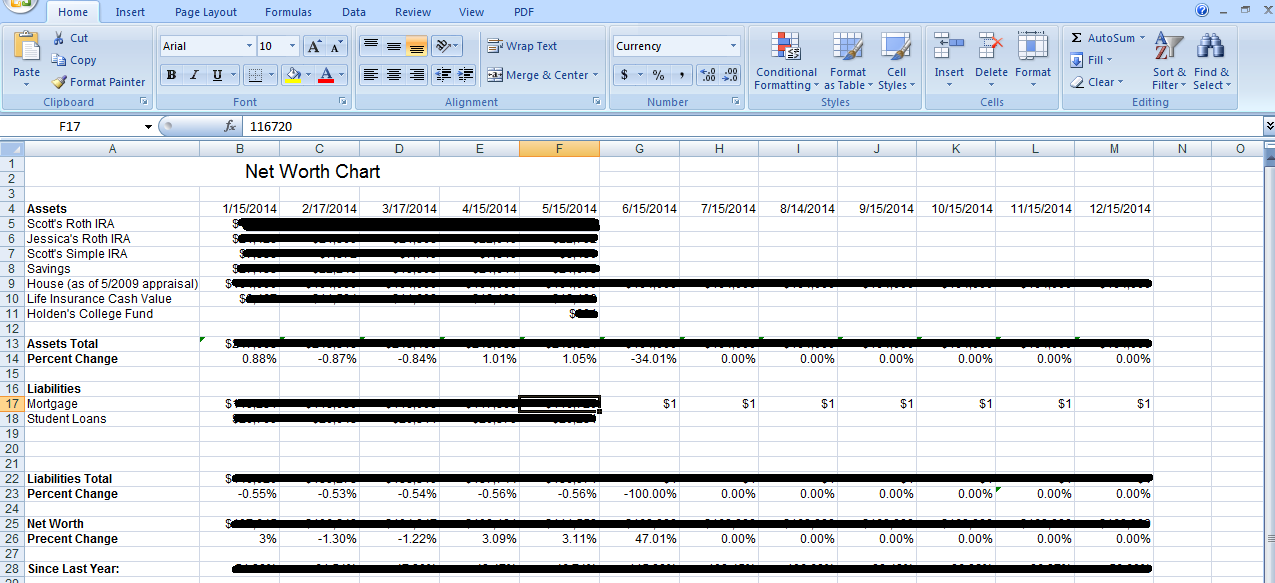

My spreadsheet is broken down into the two basic categories: assets and liabilities. Under “Assets” I have all the major assets (with the exception of vehicles because they depreciate too quickly), followed by twelve columns; one for each month. At the bottom I have a row for totals, and I have a row for month-over-month percent change.

Under the liabilities section I also have all the liabilities listed out, and the same total and percent change rows.

Beneath those sections is a total net worth row and a percent change net worth row.

Since my chart has been running for several years, I also have a final row that is the percent change since last year.

Confused? Me too. Here is a visual, it’s easier than it sounds.

The Calculations

The best part about the net worth chart is you only have to enter the calculations one time. After that everything is automatically tallied up. Doing so will only require simple Excel skills and knowing the basic formulas.

Now when you get into multiple years, you just make a copy of one page and past it into a new sheet in the same document. However, you will have to go back to the old sheet and take actual numbers for the January column and for the percent change since last year row. Other than that just delete the old numbers, change the year, and you are set to go.

The Benefits

I like to keep track of my net worth for two reasons. First of all, I like to see the numbers and having them all in one place makes it easier to do so. I am a numbers guy and seeing my handiwork is satisfying to me. More importantly I can see quickly and easily how my net worth is growing, and which accounts need bolstered. For instance, for about a year after my son was born I watched the number under savings tick down slowly and I knew I needed to get that under control. I can also see where I am with my debt and savings without having to access a dozen websites.

Wrapping It Up

Making the chart does not take long at all, especially if you know your way around Excel. Plugging in numbers is actually somewhat fun and takes a few minutes per month (I always do the middle of the month so it is after bills are paid). Now keep in mind this chart is not exact; I don’t track personal belongings, vehicles, or my wife’s teacher’s retirement fund. I wanted a quick and easy look and trying to amortize and calculate values of some of those items every month would be too hard to do. But for my purposes, this chart helps keep me on track to meet my goals.

I have been meaning to calculate my net worth. I try not to do it monthly because I get too depressed.

I am still learning how to get those equations to work. I look forward that one day I will be able to produce a table that details my every expense and saving for the whole year. It would feel fulfilling I am sure.