Sitting down and creating a budget is just about the least sexy thing you could ever do. It’s certainly a lot more fun to spend money with abandon, then deal with the consequences later. But it can be empowering to know how much you have to spend on various things each month, and to not feel guilty when following through with planned payments in certain categories.

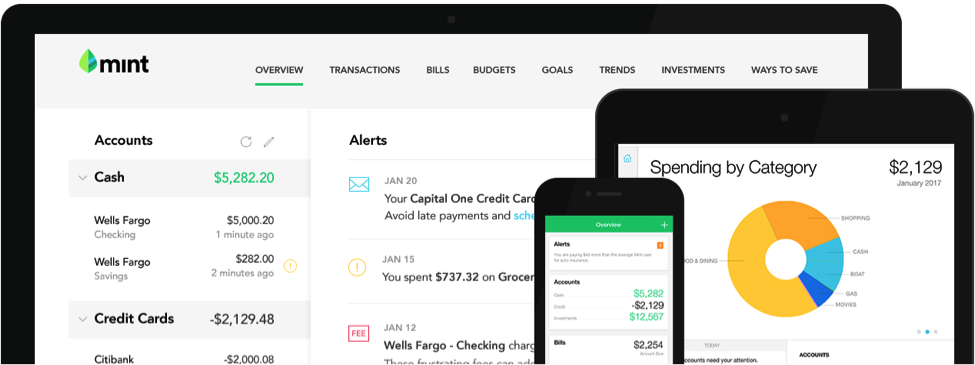

Though there are many ways to go about creating and following a budget, Intuit’s software, Mint, is among the most intuitive. After a very basic setup, it runs almost completely on it’s own on the background.

Here’s how to automate your budget with Mint.

How to Setup Mint

Mint works through third-party integrations with various financial institutions, including:

- Savings/Checking accounts

- Credit card accounts

- Investments/retirement accounts (Stocks/401k/IRA/etc.)

- Student loans

For the purpose of providing a complete financial picture, even property, like cars and houses, can be accounted for as an asset in Mint’s system. Setup is as simple as signing in (and likely answering security questions) to your various financial accounts, through Mint’s dashboard.

Of course, with so much financial data being kept in one place, the question of security inevitably arises. You’ll recall that Mint’s parent company is Intuit – also the parent company of TurboTax. Frankly, if you can trust them to submit secure information about your taxes to the government, you can also trust them to securely access your various account balances. It’s worth noting that no transactions actually take place through Mint – it’s merely a dashboard that brings all relevant information together in one place.

If configured properly and thoroughly, Mint provides an at-a-glance look at your current financial state. But Mint’s greatest strength relates to it’s use as a budgeting tool, with the ability to review and act on your spending over time.

Using Mint as a Budgeting Tool

Mint’s high-level menu options include:

- Overview: At-a-glance look at everything.

- Transactions: Line-by-line reporting on account activity. Each entry is categorized by date, a short and longer description (if you click through to view more details), a specific spending category, and amount.

- Bills: Reminders for bills due, and records of bills paid.

- Budgets: Overview of total income and spending, and how it relates to what you’ve budgeted for each category.

- Goals: Create savings goals relating to different categories (paying off debt, creating an emergency fund, buying a home, etc.), with the ability to integrate goals with planned budgets.

- Trends: Compare spending, income, debts, and more, over time.

- Investments: Charts to measure investment activity over time.

- Ways to Save: Mint’s suggestions for various financial products (accounts, credit cards, etc.), based on your connected financial data.

For our purposes, we’ll focus mostly on Transactions and Budgets. Trends is another category to pay attention to once you’ve been using Mint for awhile.

Setting a Budget, and Tracking Spending Over Time

Although Mint is smart enough to guess at your spending categories and can build an estimate of your budget around your financial data, it may be helpful to come into using the tool with an educated guess as to your main spending categories, and your estimated spending amount for each one.

Though your specific spending categories will vary, common options that will likely be relevant to you include:

- Housing

- Utilities

- Food (Groceries and Restaurants)

- Transportation/Auto

- Insurance (including auto insurance and health insurance)

- Entertainment

- Student loans

Once you’ve determined your most relevant budget categories, it’s time to get real about how much you anticipate spending in each one, on a monthly basis. Certain categories, like rent, represent fixed costs. Fixed expenses are the same month over month, and are easy to plan for. Others, like entertainment, are harder to estimate and represent variable costs.

However, an inability to come up with an exact estimate is no excuse to avoid planning to the best of your ability. So create your budget by understanding your basic personal budget categories, and assign an estimated dollar amount to each one.

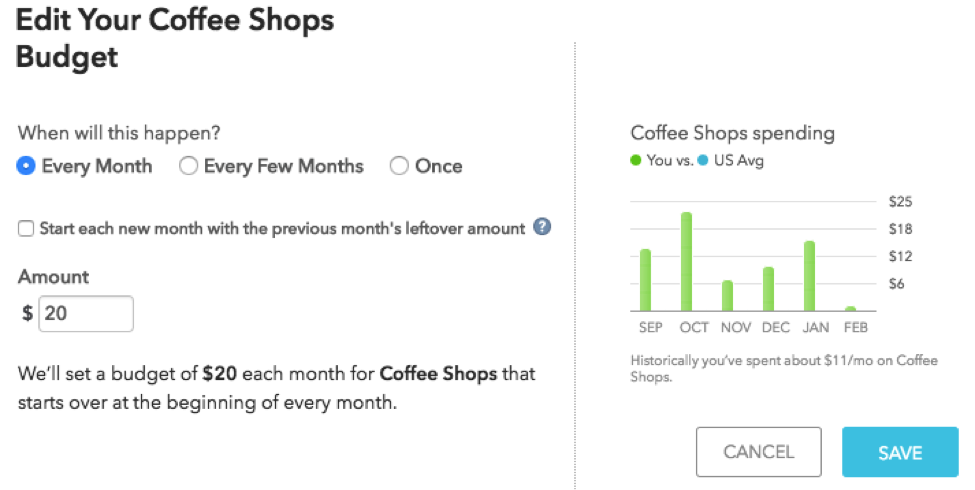

Once you’ve estimated your budget, set up categories on Mint, and input the corresponding monetary value of that budget. If you spend $20/month on coffee shops, here’s how that budget setup might look on Mint:

Mint does a great job of categorizing transactions from your connected financial accounts, especially if you frequent the same businesses over and over. But it’s a good idea to go through your list of transactions at least once a week, in case something was accidentally miscategorized. Here are transactions tagged with the category, “Coffee Shops,” which could be easily re-categorized, if Mint assumed incorrectly:

Once you’ve used Mint for a few months, you’ll be able to start comparing spending against your budget for each month. At-a-glance, you’ll be able to see if you were in the green (under budget) or red (over budget) for each Month. Clicking through to each corresponding month gives a more detailed view of spending over time, and can help you identify where exactly your money is going.

Mint’s new Bill functionality, and account alerts, help users stay on top of settling payments and account issues in need of immediate investigation. Though many credit cards and financial institutions will alert you as to questionable activity and low balances, Mint builds on these useful notifications by alerting users as to extra fees (late payments, ATM fees, etc.), high category spending in a month (compared to historical data), and more.

Good budgeting means revisiting and adjusting, according to data from actual spending. Since Mint brings in data from all connected accounts, it provides the most complete possible picture for budgeting purposes. Be honest with yourself and adjust your initial budget if your actual spending is consistently more than planned. You’re only cheating yourself if you’re dishonest about where your money is being spent.

Once you’ve taken the time to set up Mint properly, checking in on your financial health takes less than 15 minutes a week. Thanks to Mint’s handy iOS and Android apps, you could easily take care of this business while stuck in your morning commute, or waiting on an appointment. It’s easy to automate your budget with Mint!