By Erik Weisman, MFS Chief Economist

We’ve experienced a 35-year bull run, and some would argue that rates can’t go much lower (see Exhibit 1). There are several headwinds to higher rates, however, and there is a case to be made for them to decline further. The current business cycle, for starters, is entering its ninth year, a longer-than-average period of expansion. While no one can know when it will end, it will turn at some point, as all cycles do. When we get to that point, rates are likely to fall, not rise. Rates could easily eclipse the lows we’ve experienced during this cycle as we try to make our way out of the next recession.

Exhibit 1: Bond yields remain near multi-decade lows

Disinflation everywhere

There is certainly a case to be made for upward movement in rates, as they continue to remain historically low.[1] But let’s break down sovereign yields into their components. Nominal interest rates are driven by real growth (labor and labor productivity), inflation and the term premium.[2] While the labor input is running high, labor productivity, inflation and the term premium are all historically low, with plenty of room to rise. These should signal rising yields — but history may not be a great guide for us in this environment.

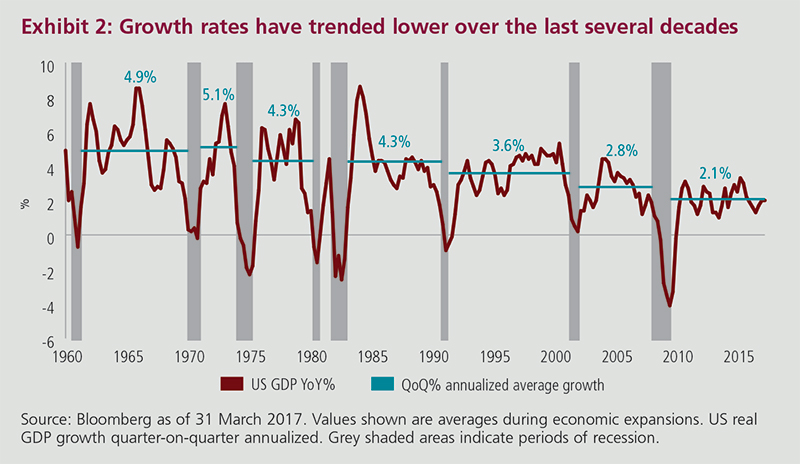

What we have seen over the last several cycles is a sustained pattern of weaker economic growth (see Exhibit 2) and a strong tendency toward disinflation — meaning inflation that is persistently low or trending lower.

Among the most important disinflationary factors is demographics. We are currently seeing weak growth in the labor force, and that shows no signs of changing soon. Lower fertility rates around the world could keep it that way for many years. Looking back at the 1960s and the 1970s, labor force growth rates increased at a very healthy clip, around 2%–3% annually. That type of labor force growth tends to generate higher inflation. When a lot of people enter the workforce, demand grows, supply has to keep up and inflation generally increases. When inflation rises, it erodes purchasing power and becomes detrimental to fixed income investors. But the demographic profile of 50 years ago isn’t coming back, which means inflation and growth will likely remain low for some time.

Productivity, another key ingredient, has been historically low during this business cycle as well, and I don’t expect it to rebound anytime soon, given that capital spending has been weak for several years now. Thus, we see another headwind to GDP growth rates and bond yields.

Exhibit 2: Growth rates have trended lower over the last several decades

Technology has also advanced and is rapidly changing entire industries as disruptive platforms, such as Uber and Airbnb, provide services and goods at lower prices. With less capital and labor needed to create considerable output, technology has become a significant disinflationary force.

We’re also living in a world of increasingly high levels of debt. Globally, there’s more outstanding debt as a percentage of output today than there was on the eve of the global financial crisis. Unless central banks move beyond quantitative easing and actually print money to directly finance consumption or public investment, debt tends to be disinflationary, as high debt levels can calcify potential future growth and inflationary pressures.

How should investors approach this yield environment?

Rates today are historically much lower than during past decades. As investors, we need to focus on the present and the future, as today’s environment is a departure from the past. Demographics, debt levels, economic growth rates and technology are all dramatically different. All of these factors are secular in nature, which means they aren’t likely to change anytime soon. It doesn’t mean that we won’t experience inflation or higher bond yields at times, but we’re likely to live in a low-yield environment for a very long while.

What does that mean for investors? While fixed income has changed over the years, investors largely have the same goals within their bond portfolios — stability, income and diversification. Bonds are supposed to provide ballast against the risk of holding equities. Even at these very low levels, bonds can still serve that purpose, especially if yields remain in a fairly low envelope for the rest of this business cycle. Investors should keep in mind that bonds are subject to risks, including market, inflation, interest rate and default, among others. At MFS®, we believe a flexible, adaptable approach that includes exposure to a wide range of bond sectors is one key to generating attractive risk-adjusted returns and managing risk over full market cycles. We think investors should remain diversified in their bond portfolios and resist the temptation to change allocations based on news headlines or whimsical economic flavors of the month.

More fixed income insights from MFS experts at MFS.com/FixedIncome

[1] As of June 2017.

[2] The term “premium” generally refers to the excess yield that investors require to invest in longer-term vs. shorter-term bonds.