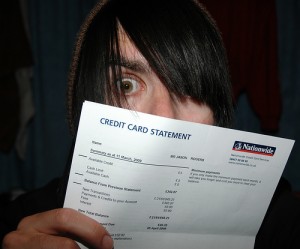

It’s no secret that we as consumers have a bit of a debt problem. Not only did widespread over-leveraging help intensify the Great Recession, but we also racked up roughly $82.5 billion in new credit card debt during 2011 and 2012 and are on pace to add another $41.2 billion to our tab this year, according to CardHub Debt Studies.

It’s no secret that we as consumers have a bit of a debt problem. Not only did widespread over-leveraging help intensify the Great Recession, but we also racked up roughly $82.5 billion in new credit card debt during 2011 and 2012 and are on pace to add another $41.2 billion to our tab this year, according to CardHub Debt Studies.

What might surprise you, however, is the identity of one of our biggest allies in the fight for debt freedom: credit cards.

That’s right, while most people think of credit cards as conduits to debt (and rightly so, if used incorrectly), they can also help you reduce the cost of existing balances and ultimately pay them off much sooner than you would otherwise. Such utility has been particularly evident in the post-recession environment, with issuers offering increasingly attractive 0% financing deals in order to garner the business of consumers who maintained above-average credit standing throughout the economic turmoil of recent years.

We’ve even witnessed the return of the free balance credit card genre, which was previously believed to be a thing of the past in light of new restrictions on fees and interest rate increases. The card that reinvigorated the genre – Slate from Chase – offers 0% on transferred debt for 15 months, doesn’t charge any fees, and can therefore save the average household – which owes roughly $6,700 to credit card companies – more than $1,000 in finance charges and months of repayment.

With that in mind, leveraging a 0% credit card is pretty much a no-brainer for any indebted consumer, right? Not exactly, but it’s important to determine whether or not you can benefit from one as soon as possible because 0% deals seem to have peaked in value, and the debt ceiling debacle is expected to add volatility to the market.

The question therefore is how to determine whether transferring a balance to a credit card is the right move for you? This process can be broken down into a few simple steps.

Evaluate Your Credit Standing

As already mentioned, the best 0% deals are targeted to people with good or excellent credit. There are a number of ways to determine if you fall into either of those buckets, but it’s likely that you do if you’ve had a credit card or loan for at least three years and you’ve never been more than 60 days late on a payment or declared bankruptcy.

Determine Which Debt to Transfer

Unbeknownst to most consumers, you can actually transfer many different types of debt (i.e. not just credit card balances) to credit cards. In fact, seven of the largest credit card issuers allow you to transfer most types of consumer debt, including that which originates from auto loans, small business loans, student loans, and even mortgages, according to a 2013 CardHub report. But just because you can doesn’t mean you should. Rather, you need to think long and hard about which debts would benefit from a transfer and your ability to pay them off within a year or so (the average 0% term lasts for just over 10 months).

Compare Available Offers

Direct product comparison is the best way to ensure that you garner the most lucrative offer. Don’t make the mistake of simply comparing the length of cards’ 0% introductory terms, as that is one of the only factors that will dictate your potential savings. Rather, you should compare the total cost of each offer – factoring in the length of the 0% term, the balance transfer and annual fees, and the regular interest rate that will take effect once the 0% term concludes.

Make a Payoff Plan

You have to act under the assumption that 0% balance transfer deals won’t be available after your card’s intro term concludes, which means you must plan to pay off all or most of what you owe before regular rates kick in. Before the recession, a lot of folks made the mistake of hopping from 0% card to 0% card, using them to perpetuate unsustainable spending habits rather than to reduce leverage, and they paid the price in terms of high interest rates when the music stopped and 0% deals vanished.

The easiest way to devise a payment plan that enables you to comfortably pay off most of your debt during the 0% period and thereby maximize your savings is to use a credit card calculator. Should you discover that you’ll be unable to pay off your full balance before regular rates begin to eat away at your savings, consider only transferring part of your balance to the new credit card.

Final Thought

At the end of the day, it’s clear that we as consumers need to address our everyday reliance on debt if we want to avoid a double-dip credit crunch. The right balance transfer credit card can help you escape debt relatively unscathed, but you’ll need to couple that with a well-thought-out budget and some good old fashioned self-control in order to prevent history from repeating itself.

Odysseas Papadimitriou is the CEO of the personal finance websites CardHub and WalletHub.

I’ve managed to get nearly half of my card debt onto 0% deals. Its crazy paying interest when you dont have to, and makes a big difference in the speed my debts are reducing.

Pity I cant get it all on 0% but maybe one day.

The less interest you pay – the sooner the debt goes away

Good way to put it. Less amount you pay in interest the quicker you are done paying all together.