During our teenage years we feel pretty much invincible. As we get older, that feeling subsides some, but even when we hear about our peers being injured or dying early we often think, “That will never happen to me.” As we progress in our careers we have a good income, we have created a budget, set aside money for savings, but many people often neglect to take care of what happens if they are not able to provide an income. Any solid financial plan needs to have its foundation in protecting their income flow.

Income Flow

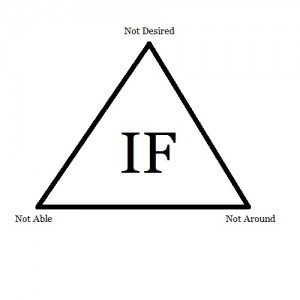

Throughout our working years, everyone provides an Income Flow (IF). However, there are three ways that an income flow will stop. All three need to be addressed when a person is setting goals and making their financial plan.

No Longer Desire to Work

At some point people will no longer want to work. We call this retirement. They simply do not desire to provide that income flow anymore. This part of the plan is easy, and often fun to map out. We can calculate out how much we to save based on average rates of return and our desired age of retirement.

No Longer Able to Work

Sometimes, in the middle of our working years, a life event will occur that suddenly the wage earner will not be able to provide an income flow anymore. An injury or sickness will happen where they will still be alive and wanting to work, but they will not be able to. To protect against this happening, the individual needs disability insurance.

Not Around to Work

Those same sicknesses and injuries can often have fatal results. When someone dies they are no longer around to provide that income flow. For those with a family, this can mean a huge financial burden in addition to the grief they are already suffering. Rather than risk it, the provider should have some sort of life insurance. Those who are single would best be served by having at least enough to cover their final expenses.

As we progress in life and careers we often ask ourselves, “Do I need insurance?” The answer is: yes. Regardless of if you have a family or not, the need is still there. The only thing is, most people do not care to insure an intangible asset such as their income flow. They do not bat an eye at insuring a $200,000 house. But they will often get defensive when an insurance agent talks to them about insuring millions of dollars of future income. In order to have a secure financial plan, and be able to retire when you desire, the base of your financial pyramid should take care of the unexpected income flow needs.

Did you enjoy this article? If so sign up for our daily newsletter so you can stay on top of every personal finance topic we cover. Also check us out of Facebook, Twitter and Google+.