One of the best things you can do to set yourself up for financial success is contributing to your 401(k). If you’re anything like me though, you probably “review” your 401(k) investments annually and otherwise leave it alone. That’s where Blooom comes in.

Blooom is a robo-advisor that’s designed specifically for your 401(k), and with Blooom, you can take your 401(k) management from passive to aggressive — in a good way.

How Does Blooom Work?

To start, you’ll need to register for a free Blooom account. This is where you’ll provide Blooom with some basic information about yourself, and then link your 401(k) information.

Blooom “scans” the information from your 401(k) and provides you with a free analysis. This feature alone is well worth your time.

Related Articles

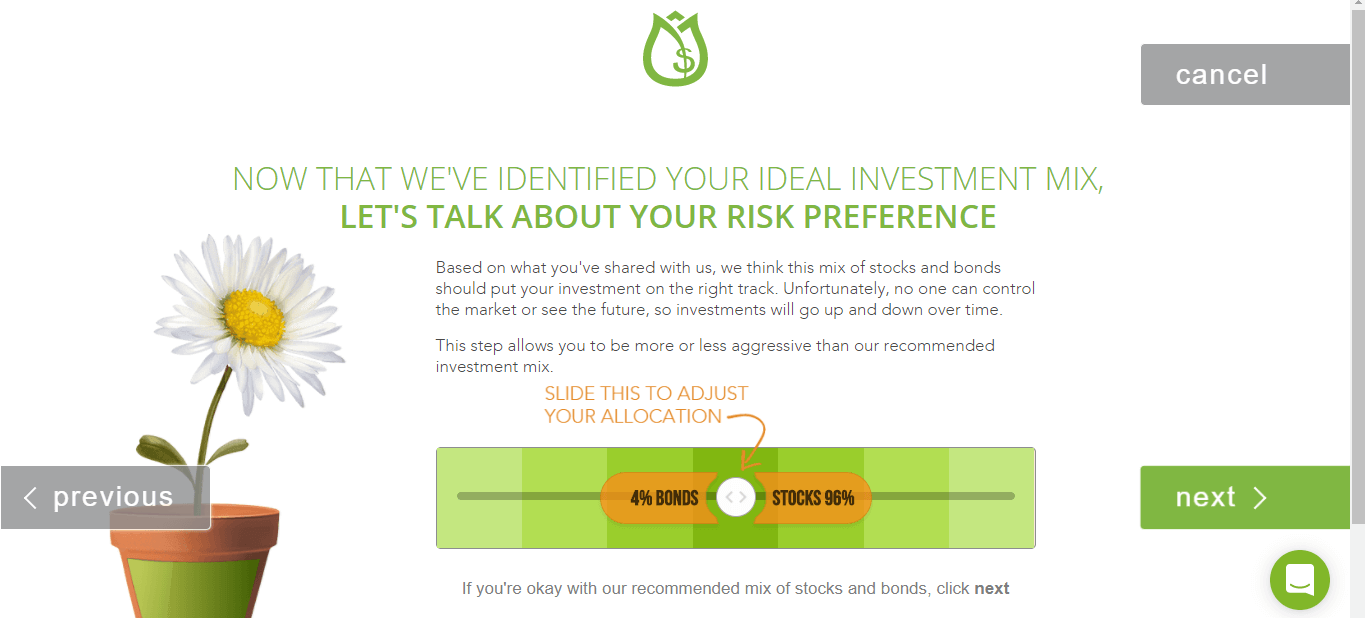

Most company default allocations don’t do a good job of matching your long-term investment needs, and Blooom’s analysis will give you the information you need to get back on the right track.

If you’re pretty investment-savvy, you can run with Blooom’s analysis and update your 401(k) asset allocations yourself. But keep in mind that your 401(k) should be a dynamic type of investment.

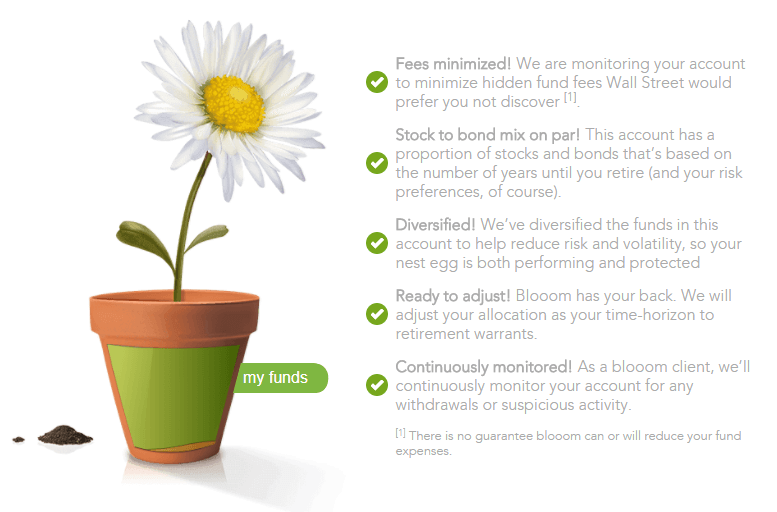

That’s where Blooom’s management service can provide anyone – from novice investors to pros – some extra peace of mind. Management with Blooom includes a full analysis and rebalancing of your 401(k) every 90 days. And you’ll get an email every time Blooom makes an adjustment on your behalf.

How much does Blooom Cost?

You might be thinking that a 401(k) robo-advisor is way out of your price range. But that’s where Blooom delivers even more value — it’s surprisingly affordable!

Whether you just opened your 401(k), or you’re decades into your investment, Blooom costs $10 per month. So for less than the cost of your streaming subscription, you can take advantage of Blooom’s ability to manage and monitor your account. If you’re not loving it, you can cancel at any time.

Receive Your FREE 401(k) Analysis From Blooom

Can Blooom Make Me More Money?

It’s a little harder to quantify, but using Blooom over time should result in more gains in your 401(k). By choosing asset allocations with low fees, Blooom aims to save their customers money and get the most bang for your buck.

With Blooom’s help, it’s perfectly reasonable to believe that your small $10 per month could result in an optimized 401(k) that more than offsets your out-of-pocket costs.

I already use a robo-advisor. Why should I use Blooom?

Number one: good for you. There are a lot of great robo-advisors out there that can help you invest smarter. What Blooom offers is targeted at your 401(k), which is an account that most other robo-advisors either gloss over or aren’t able to manage at all.

Blooom’s different because they don’t hold your money for you like a traditional investment firm. Instead, they focus on expertly managing your 401(k) wherever you already have that account.

Is Blooom Safe?

One of the features that convinced me to try Blooom is that they don’t move money away from its current institution. Your money stays in your 401(k) account, and Blooom simply changes the overall asset allocation when needed.

Plus, Blooom provides access to a financial advisor, so you can ask questions and get answers from an unbiased expert. Seriously. Because you pay Blooom a monthly fee rather than a commission on trades, you can be confident you’re getting the best advice for you and your individual situation.

Related Articles

- 7 Questions You Need to Ask When Choosing Between a Robo-Advisor and Financial Advisor

- Should I Use a Financial Advisor?

- Understanding Financial Advisor Fees

What You Can Expect from Blooom

- A straightforward sign-up process

- No credit card required to get your free 401(k) analysis

- An easy-to-understand and transparent approach to management

- No hidden fees!

Is There a Downside?

Because their analysis is free and you can cancel your subscription at any time, there’s not a big financial downside to using Blooom. Unless you’re already paying an expert to manage your 401(k), Blooom’s services will help fill that gap in your portfolio on an ongoing basis for a very reasonable monthly fee.

And one of the biggest draws for me compared to other robo-advisors is that Blooom makes money from the subscription, not from selling or trading your assets. So any moves they make on your behalf are truly, 100% unbiased.

Full disclaimer though: with any investment, you’re the one taking the risk, not Blooom. Just like any other robo-advisor, their results are not guaranteed. But really, how much do you have to lose?

What I’d love to see from Blooom in the future is expansion beyond 401(k) accounts. Right now, they only manage employer-sponsored retirement accounts. So if you have an IRA or any personal investment accounts, Blooom can’t help you.

Receive Your FREE 401(k) Analysis From Blooom