After working for about 45 years of your life, most people would prefer to retire and go spend their sunset years quietly in the peaceful recesses of the country side. However, with the increasing quality of life and the rising life expectancy for an average citizen in the UK, the retirement period can run up to 30 years. Having three decades at your disposal to spend as you wish, there is so much you can do rather than just sit idly from day to day in the country side. In addition, the cost of living is ever increasing and as you advance in age you will start incurring more costs on nutrition, healthcare and other life improvement costs. The need to have other sources of income to supplement your basic state pension therefore becomes a necessity.

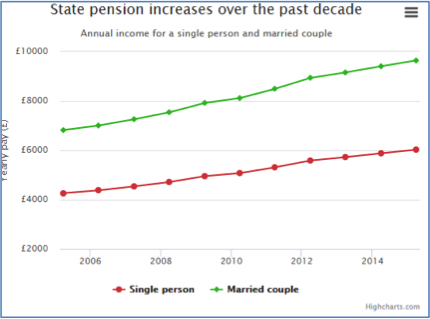

In the UK, the basic state pension was increased in April 2016 to about 155 pounds per week which cumulates to an annual payment of about 8,000 pounds. To qualify for the state pension, one needs to have been employed or self-employed in the UK and has made National Insurance Contributions for a given minimum number of years. Not everyone meets these pre-conditions for qualification to get the basic state pension; and even if you meet all the required conditions, the amount given is the bare minimum you need to survive. To improve the quality of your life after retirement you will need to find passive sources of income that do not require much energy input; but which can create regular income streams that can help you afford a little bit of luxury anywhere in the world. Some of these passive sources of income include the following:

- Online trading

With enough time to study markets and good internet connection, online binary options trading will help you invest indirectly on the capital and commodity markets without having the risk exposure to the underlying asset. All you need to do is to analyze the markets for the commodities or investment assets you are trading on and ensure you are well updated with the latest trends and the projected market movements. Armed with this information, you then place your trades each day and get your returns at the end of your trading period without having to interfere with the trade you placed earlier on.

- Becoming a silent business partner

There are very many start-ups with high growth potential that need capital and strategic partnerships in order to scale their operations. Using your savings over the years you can invest in such small businesses and be earning annual income from your profit share as an angel investor. As a silent partner, your role will be minimized to offering strategic advice and probably sitting in their board meetings as a director once in a while; while the rest of the team runs the day to day activities.

- Invest in real estate

Real estate is one of the most preferred forms of passive investments due to the ease of operation and the high regular income you get when well planned. When venturing into real estate with a goal of earning passive income, you will need to contract a property management company to dealing with the day to day management of your rental houses and submit monthly rental income to your personal or business account. The initial capital outlay when investing in real estate will however be higher compared to other sources of passive income.

- Offer consulting services

Backed with the many years of experience you had within your industry and the networks you created; when you retire you can also consider being an independent consultant within your areas of expertise. When going the consulting way, you will need to decide whether you will be doing it on a regular part-time basis or on a freelance basis whereby you get jobs and do them when you have the time. In addition, you will need to set your prices either to be a flat rate or to be based on an hourly rate. All those decisions notwithstanding, you will need to ensure that the cost of offering your consulting services and your level of engagement is adequately compensated.

A myriad other sources of passive income exist for one to choose from after retirement including blogging, writing e-books, creating videos on YouTube, investing in index funds and selling your own products via the internet among many others. Your personal choice will however be determined by both your personal preferences and your age as you grow older.