This is a sponsored post written by me on behalf of Chase Mortgage Banking for IZEA. All opinions are 100% mine.

The great recession technically ended in June 2009, but many Americans are still feeling long lasting effects. Some of those are good, such as the low interest rates that we have been able to enjoy for the past several years, and some of them are not as good, such as the unemployment rate that is taking a long time to work its way down to a reasonable level.

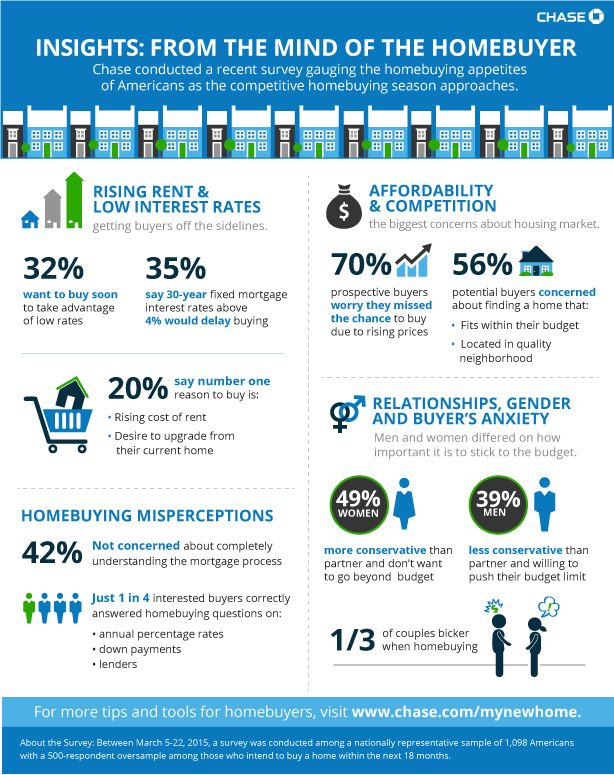

To gauge consumer interest in buying a home, Chase Mortgage Banking conducted a survey. It turns out that there are a lot of people out there who are looking to buy; and the reasons vary considerably.

Consumer Interest in Homebuying

Real estate costs are picking back up. Because of this rise in prices, there are a number of people out there that want to buy before the price gets too much higher; in fact the survey shows that 3 out of 10 Americans want to buy in the next 18 months (many of them are house hunting now during the 2015 spring and summer homebuying season). The motivation to buy soon? 20% of those who responded stated that the rising cost of renting, which makes owning a better value, is their number one reason to buy; and, for those who are already homeowners, 20% say their desire to upgrade from their current home is their number one reason to buy.

It’s not just the fact that prices are going up for homes, it’s also that interest rates are likely to increase this year. Low rates, increasing rental costs, and increasing housing costs mean that it is a perfect time for many people to get off the fence and make the decision. But that decision needs to be made soon; 35% of potential buyers say that if the rates go over 4% (for a 30 year fixed rate mortgage) they would likely delay their decision.

So if the interest rates are great, and the cost of rentals is going up, why are so many people still putting off their decision? One reason is that many people feel they missed the bottom of the market. In fact, almost 70% feel they have missed the best buying opportunity due to the rising cost of homes. An even bigger factor, however, is the fact that many people simply don’t know what to look for or what to expect when it comes to buying a house.

Resources Available to Homebuyers

Fortunately, there are a great many resources available online and in the community. To begin with, everyone who is interested in buying a home should start their learning process online. It doesn’t cost anything, and can be done whenever there is spare time.

Not only does One Smart Dollar have a number of great articles, there are some other resources that dive into different aspects of the buying process. For example Chase has a YouTube channel called My New Home. On the My New Home YouTube channel there are dozens of high quality videos that answer all sorts of questions that range from credit score, to pre-approval, to inspections, to what you do if your loan application is declined. If you’re not into videos, and you would rather read the information, Chase Mortgage Banking has plenty to read as well.

Sometimes, however, you need to interact in order to get your specific questions answered. That is a lot easier than you think, and there is no reason you should ever pay for a class. Simply call your Realtor or the agent with whom you are working, and ask about a first-time homebuyer class. There should be one offered at least every weekend, and it is there that you can get the majority of your questions answered.

Is 2015 the Year You Buy a Home?

Have you been looking at buying a home? There is speculation that in June 2015 interest rates are going to start ticking back up. If they do, your mortgage will only get more expensive. If you want to get locked into a lower interest rate, it may be beneficial to buy your house sooner rather than later.

What are the biggest factors in your homebuying decision?