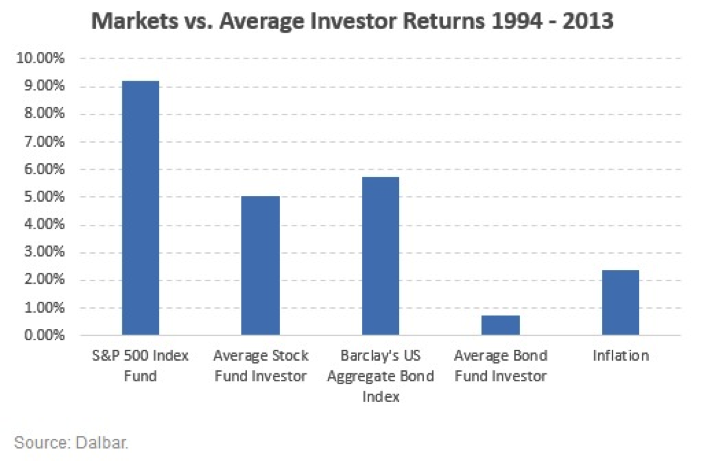

Most likely, you are reading this post because you desperately need an alternative to stocks and bonds for your investment portfolio. While the long-term return on stocks has averaged around 9% over the last couple of decades, most investors miss the average by a long-shot and bonds are paying next to nothing in the ultra-low rate environment.

Also just as likely though, you are probably more than a little hesitant to make peer lending a part of your investment strategy.

Sure, investing in peer loans is risky but no more so than other investments. Like most investments, the risks in peer lending can be hedged away with a careful investment strategy and adding this new asset class to your portfolio can actually help lower the risk in your overall portfolio.

Peer Lending: Risks and Returns

Investing in bank loans is nothing new. It’s just that, before peer lending, investors had to go through a bank or a brokerage firm to find loans in which to invest. The two lending sites, Prosper and Lending Club, are revolutionizing finance by connecting investors and borrowers directly. Borrowers apply online and are verified by the sites before the loans go online for investors to review. Investors decide in which loans and how much to invest, from a minimum of $25 for each selected loan. The borrower sends loan payments to the website which handles all the processing and passes the payments on to the investors. For a more detailed description of the process, see my recent review of the two peer lending sites.

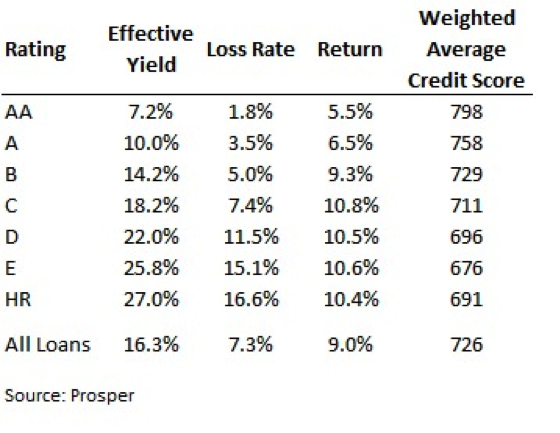

Returns on peer loans have been much higher than other income-investment options like bonds but have lagged stocks over the last several years. The return on loans originated on Prosper over the past five years has averaged 9% for all loans and nearly 11% for high-risk loans.

The biggest risk to peer loans is that they are unsecured credit, not backed by a house or a car. If the borrower misses a couple of payments the lending platform will send the loan to a collection agency but only about a third of these go back into payment status. Still, the loss rate on loans is surprisingly low with defaults for the best-rated loans under 2% over the last five years. Even default rates at higher-risk loan categories can be manageable by spreading your investment across several categories.

The table below shows the loss rate and actual return for loans on Prosper over the last five years.

Talking with new investors, one of the most frequent mistakes I see is jumping at the double-digit rates in the highest-risk categories before the investor understands their own risk tolerance. A lot of investors sour on peer loans after seeing nearly a fifth of the loans in their portfolio default, even if they still end up earning a high return on the portfolio.

If you get skittish over short-term losses, you should stick with loans from the highest-rated categories. If you can look to the longer-term, understanding that while some loans may default you will still earn a strong return over the whole portfolio then you might consider investing in higher-risk loans.

Is Peer Lending any More Risky than Other Investments?

So if the risks in peer loans can be managed according to your risk tolerance, then maybe the question should really be, “how do these risks stack up against other investments?”

You should see where this is going. Anyone that has been investing for more than a few years should recognize immediately the risks in investing in stocks or bonds. If you’re like me, you are still a little gun-shy after seeing stocks lose half their value in 2008. Even bonds, supposedly safe investments, had bouts of high volatility during the financial crisis and record low interest rates mean you are barely breaking even after inflation.

Beyond the risk of loss in stocks and bonds, what kind of return are you actually earning from those investments? Research firm DALBAR reports that the average investor misses the average return on stocks by nearly 4% and actually loses money on bonds after inflation due to buying as the market peaks and panic-selling during crashes.

But we still haven’t gotten to the real question, have we? Any investment by itself is likely to be too risky relative to returns on a well-diversified portfolio. So the question should really be, “are peer loans too risky for a regular portfolio?”

Besides high returns on peer loans, adding loans to your portfolio of stocks and bonds could significantly lower the risk in your portfolio while increasing returns. Using the S&P Experian Consumer Credit Default Index as a proxy for peer loans, the return relationship with stocks and bonds is nearly zero. The correlation, a measure of how closely the investment returns follow each other, is 0.014 for stocks and 0.28 with bonds. That means that if the stock market takes another tumble, those peer loans in your portfolio could protect your wealth from taking a tumble along with the market.

I may be a little biased as the owner of a blog on peer lending but have tried to lay out the facts. While there are risks to peer lending, the investment is no more risky than traditional investments and may actually lower the risk in your overall portfolio. The industry is still in its infancy and you should look into it further before you make the decision whether it’s right for your portfolio. Whatever your decision, whether to include peer loans in your portfolio or not, make sure you are asking the right question.

Peerloansonline.com is your first stop into the world of peer lending. Whether a borrower or an investor, you’ll find everything you need to make your experience a success along with tips on personal finance and managing debt.

One Comment

Comments are closed.