While automation may be the future, we cannot discount the value that a human can add to a product. Perhaps blindly trusting computers is not your ideal scenario, especially when it comes to your investments. This is when a company like Personal Capital can be useful. They will help you both keep track and manage your wealth.

Within this Personal Capital review we will talk about the two parts to Personal Capital’s strategy: financial analytics and wealth management. The analytics section will let you do things like budget, calculate your net worth, analyze the fees your broker charges, and view your general investment scheme. The wealth management part will optimize your investments by assigning a dedicated advisor to your account. This part also offers a few similar features to other fintech advisors, such as tax harvesting. They will take all of your wealth into consideration, not just the funds you have with Personal Capital.

Financial Tools from Personal Capital

Net Worth Analyzer

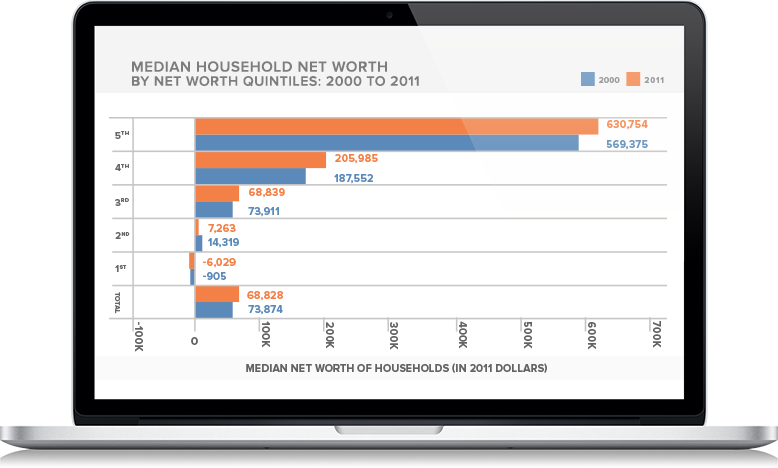

The financial tools are where the company helps you budget and keep track of your investments. They bring all your financial information together in one place so you don’t have to worry about aggregating all the data in your head. You can link your personal checking accounts, your credit cards, your mortgage payment, and your portfolio all to the Personal Capital platform. This is how they can calculate your net worth. Every time you sign in to the app, you can see an updated calculation of your net worth.

The net worth analyzer will:

- Show you all your assets and liabilities in one place

- Let you compare your net worth to others’

- Give you a long-term appreciation of your investments

- Let you track your portfolio

- Keep you on track for your financial goals by providing insight into your debt-to-asset ratio

Sign Up For Free Financial Tools at Personal Capital

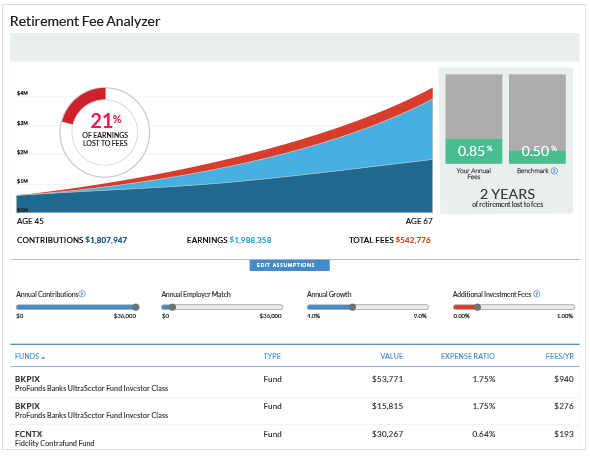

Fee Analyzer

One thing that you may find when using the net worth analyzer is that brokerage fees add up. To see exactly how much, use Personal Capital’s Fee Analyzer. Those little one or two percent fees seem like nothing, but on a life-long portfolio, they could add up to hundreds of thousands of dollars. That could be years of retirement that you are throwing into a black hole because you aren’t looking closely enough. Fee Analyzer will show you what you are paying now and give you a calculator to see how it could change.

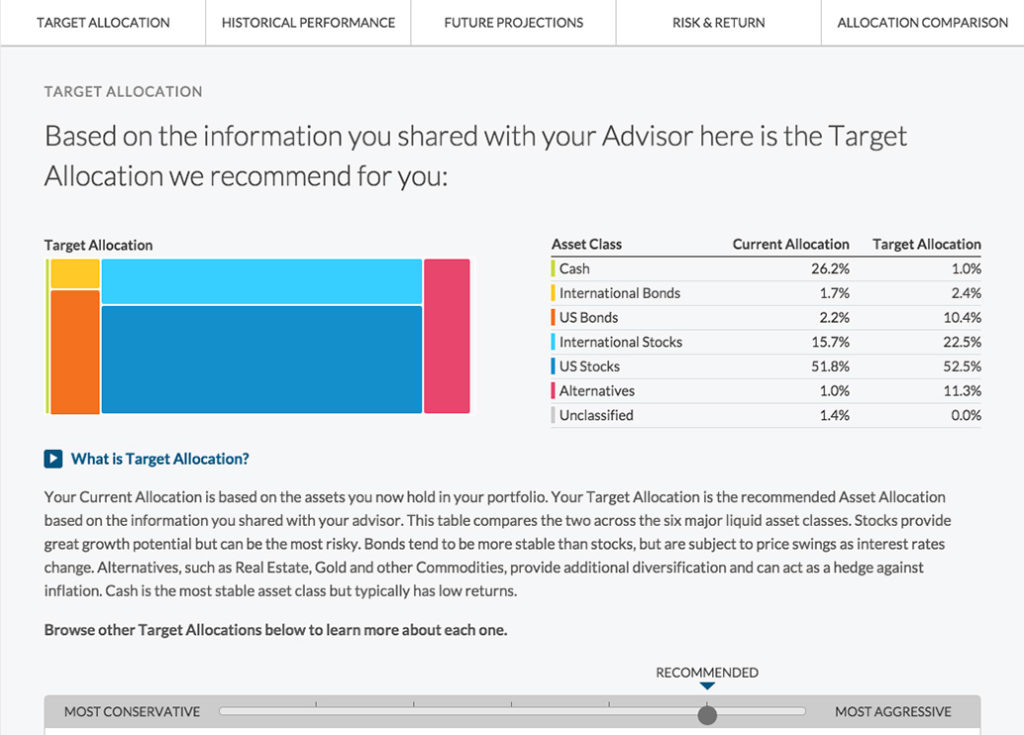

Investment Checkup and Retirement Planner

You can use the Investment Checkup tool to gauge your current portfolio (both inside and outside Personal Capital’s management) against the average. You can test your historical performance and see how your investments compared. Plus, if you seem to have too much risk, the tool will make suggestions on how to reduce your risk. However, you can’t eliminate the unforeseen, so they also have a retirement planner that will include unexpected events.

The Retirement Planner lets you see how close you are to your goal of retirement by a specified date, and you can then manage your investments from there. For the best results, you’ll need to share your total monthly income. This will better help the software plan for future events: the unexpected, like an illness, and the expected, like college expenses for your children and, of course, retirement.

One cool feature of the retirement planning tool is that it can extrapolate your retirement spending from your current spending. The extrapolation uses probabilistic models and the data it has skimmed from your current and past financial history. You can learn a lot about yourself and your financial situation by finding out if your current spending habits can continue in retirement with your current retirement scheme. At the very least, you will be able to know now how your habits should change, if at all.

Wealth Management with Personal Capital

The other aspect of Personal Capital is the wealth management. Computers will be doing the grunt work, but humans are still checking the results and giving you advice. The main selling points, right from the company itself, are:

- Their fiduciary duty and acting in your best interests

- Avoiding hidden fees with their single management fee, as opposed to several little fees that nickel-and-dime your returns away (see Fee Analyzer)

- Optimizing risk and return

- Providing a human contact point through phone, email, chat, and, interestingly, web conference

- Customized investment strategies that look at your whole financial situation

- Tax optimization through the use of tax harvesting and allocating higher gains to non-taxable accounts like retirement funds

You will get licensed advisors and, when you first start, an initial meeting – so those advisors can understand your situation better. The fee schedule is based on how much you invest:

Personal Capital Fees

| Personal Capital Fee Schedule | |

| Up to $1 million | 0.89% |

| $1 million to $3 million | 0.79% |

| $3 million to $5 million | 0.69% |

| $5 million to $10 million | 0.59% |

| Over $10 million | 0.49% |

Private Clients

As you become older, you accumulate more wealth (hopefully). And as you accumulate more wealth, your investments become more complex. Personal Capital understands this, and they offer a service for such customers. They are dubbed the “private client group”, and if you invest more than $1 million, you will become a member. They offer the usual VIP services for these accounts. You can also listen in on the quarterly conference call of the advising team and obtain opportunities to invest in private companies and ventures.

Additional Services

The wealth management portion of the business is not only for retirement. That is a big part, but they will help you with many “life milestones”. These can include setting up a college fund, insurance allocation, purchasing a home, management of your company stock options, and estate planning. When you have your initial meeting, you can talk to your advisor and they will help you get set up. If you want to add any services after you start, of course that is possible.

Personal Capital – By The Numbers

Even with the human element, this is still a fintech company. They themselves advocate the use of technology. The goal is to make financial management more affordable, more accessible, and more honest. The first two tend to go together, as a lot of people feel they are locked out due to high fees or not enough capital to start with. The company now tracks $270 billion for clients, with $3.4 billion under management directly from the company. They also boast 1.1 million users.

Wrapping It Up

Their vision is to marry technology and financial advisement together while still retaining the human element. Personal Capital wants to be a one-stop shop for all your financial needs. For that they offer a wealth of services for both financial health tracking and wealth management. They are transparent and only charge one fee rather than several hidden fees. They offer you complete overview of your financial situation and give you a better perspective on whether you are on track or need a change.

If you don’t want to go with a robo-advisor that is almost entirely automated, then this may be the company for you. You can talk to a real person and have someone review and make investment decisions rather than relying exclusively on software. This is especially important if you have a complex investment scheme. It is easy to automate the simple tasks, and there is an incentive to automate the more complex, but very common, tasks. For personalized investment strategies, though, it is still a human game. At the very least, the company can offer you a good picture of your financial health, even if you decide not to invest with them.