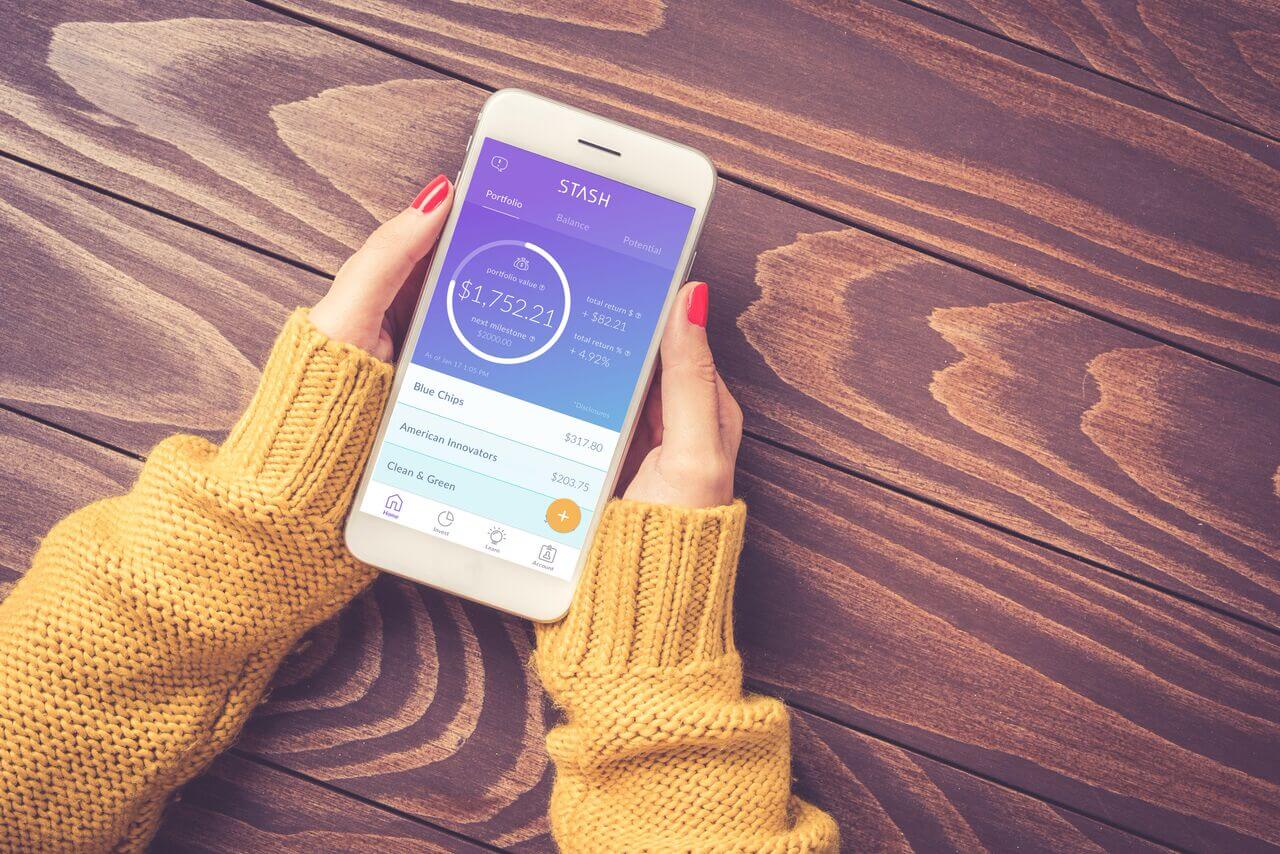

Every day, new apps are being developed to make it easier for people to manage their finances. One of my favorite financial apps is Stash. Stash is an investment app that allows anyone to start investing with as little as $5. And as you become a more seasons investor, Stash has features to make your experience even better. I’ve been using Stash for over two years now, and it’s safe to say I’m hooked. That’s why I wanted to share my Stash Invest review and highlight some of my favorite Stash features.

What is Stash?

Stash is an app that helps people invest with micro-investments of as little as $5, although there’s no limit to how much you can invest. Stash charges only $1/month for an account with a balance of less than $5,000. Accounts with balances over $5,000 are charged a very reasonable 0.25% fee. Your first month is free, so there’s no reason not to give Stash a try.

How does Stash work

Stash gives you access to purchase around 30 ETFs with low expense ratios. Low expense ratios mean more of the money invested actually gets invested. Plus, they have fun names like “Internet Titans” and “Real Estate Tycoon.” You can make one-time investments, or set up auto-deposits to make investing a habit.

Is Stash worth it?

Stash makes it easy to invest in any variety of funds and set up automatic purchases. This takes the hassle of investing out of your life completely. Set it, forget it, and watch your wealth grow.

Keeping you updated on news

One of the features I love about Stash is that when I sign into the app, Stash tells me about recent news items that may affect my investments. Not only is it interesting, it has helped me learn more about investing and how the stock market moves in response to real-life events, like mergers or new company marketing plans. Thanks to Stash, I’m a smarter investor and my friends think I’m a stock market genius.

Stay motivated

I have a busy life, and investing isn’t always my top priority. That’s where Stash comes in. With my auto-Stash, I know that my weekly investment will always go through – whether I’m thinking about it or not. This is great for helping me stay on track with my investment goals. Plus, Stash has cool features like a balance history graphic and a growth potential calculator so you can see how even the tiniest investments can add up over time. Stash has beautiful visuals that really shed light on your investment journey and where you’re going.

Stash for retirement

Now, you can get a retirement account with the same great Stash experience. For as little as $15, you can open a retirement account from Stash in the form of a Roth or traditional IRA. The management fee is only $2/month if you have a balance less than $5K, and for higher balances, Stash charges a flat fee of 0.25%. That’s way less than most retirement account managers, so planning your retirement investments through Stash is a no-brainer.

Is Stash a robo-advisor?

Nope. Stash puts you in the driver’s seat of your investing. Unlike robo-advisors, like Betterment or Wealthfront, Stash doesn’t use an algorithm or make changes to your investments on your behalf. Stash enables you to invest in the funds that meet your needs. Of course, Stash provides awesome guidance along the way by giving you complete clarity into your choices. I like to invest in a mix of aggressive and moderate risk funds, which are all conveniently labeled by Stash. And if I want to know more about a certain ETF or have questions about what investment strategy might be best for me, I just look at the Stash blog. They have wealth of resources! (No pun intended).

Is Stash safe?

Stash has one of the best reputations out of any investment apps on the market because of the strides they take to make your information safe and secure. At the time of this review, Stash has a rating of A- by the BBB, which is impressive for a financial services company! Stash also lets you withdraw money from your account if you sell your investments. The timeframe to do that is 2-5 business days, which is the same as any other investment service because of US laws, stock market hours, and bank processing.

One thing I found reassuring is that all the investments I make through Stash are owned by me. That means if Stash goes out of business, I still have ownership of all the investments in my account. The balance of Stash Invest and Stash Retire accounts are protected through SIPC, which is the gold standard for investment services.

Ready to try Stash?

Download Stash from the App Store or Google Play to get started today with just $5! You’ll be doing yourself a huge favor for less than the cost of a burrito. You can thank me later.