TD Bank is one of the largest retail banks in the United States, with locations in 15 states and Washington, D.C.

If you are looking to open a checking account, several TD Bank promotions are available to new customers.

However, the bank promotions don’t end with checking accounts. They also have new account bonuses available for savings accounts and credit cards.

One thing about most TD Bank accounts is that they come with monthly maintenance fees. Luckily, there are ways to waive the monthly maintenance fee, including setting up qualifying direct deposits and maintaining certain account balances.

TD Bank Checking Account Promotions

TD Beyond Checking – Earn a $300 cash bonus

Through January 31, 2025, you can open a new TD Beyond checking account and earn a $300 bonus. All you need to do is complete the required activities.

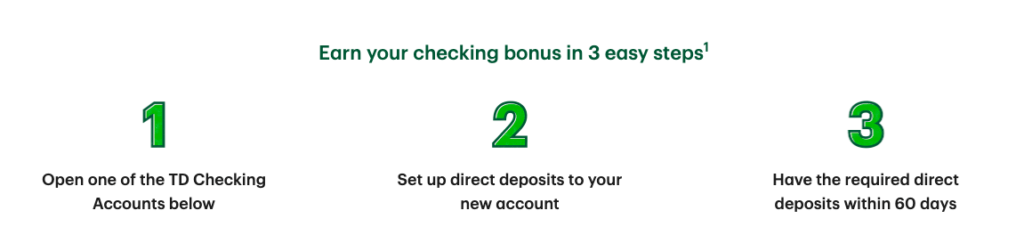

To earn your TD Bank bonus, follow these instructions.

- Open a new TD Beyond checking account.

- Set up at least $2,500 in qualifying direct deposits within the first 60 days of account opening.

Once you complete the requirements, your bonus will be paid into your new account within 180 days of account opening.

TD Beyond Account Features

Monthly maintenance fee: With your TD Beyond checking account, there is a $25 monthly maintenance fee. This can be waived in any of the following three ways:

- Set up $5,000 or more in direct deposits during the statement cycle.

- Maintain an average daily balance of $2,500.

- Maintain a $25,000 minimum average daily balance between all TD accounts.

Eligible for TD Early Pay: Set up eligible direct deposits into your TD Beyond checking account, and you’ll have the chance to receive your paycheck up to two days early.

Reimbursed ATM fees: If you maintain an average daily balance of $2,500, you’ll have any non-TD Bank ATM fees reimbursed.

Stay Updated on the Latest Bank and Credit Card Bonuses!

Want to earn extra cash? Join thousands of savvy readers who get exclusive updates on the best bank and credit card bonuses delivered straight to their inbox!

I hate spam as much as you do. We’ll never sell your information to anyone.

TD Complete Checking – earn a $200 cash bonus

Through January 31, 2025, you can earn a $200 cash bonus when you sign up for a TD Complete checking account. All you need to do is complete the required activities.

To receive your bonus, complete the following requirements.

- Open a new TD Complete checking account.

- Set up qualifying direct deposits of at least $500 within the first 60 days of account opening.

Once you complete these requirements, your bonus will be paid into your new checking account within 180 days.

TD Complete Checking Features

Monthly maintenance fee: This account has a $15 monthly maintenance fee. This fee can be waived in the following four ways.

- If the account holder is between the ages of 17 and 23.

- If you have total direct deposits of at least $500 within a statement cycle.

- If you maintain a minimum daily balance of $500.

- If you have a minimum daily balance of at least $5000 in all TD Bank accounts.

TD Early Pay: you can receive your paycheck up to two days early when you set up eligible direct deposits into your TD Bank checking account.

TD Complete Checking for Students – $100 cash bonus

If you are between 17 and 24, you can open a TD Complete checking account for students and earn a $100 bonus.

To earn your bonus, you’ll need to complete the following requirements:

- Open a new TD Complete checking account for students.

- Make at least 15 qualifying transactions with your TD Visa debit card. This does not include ATM transactions.

Once you complete these requirements, your bonus will be deposited into your new account within 180 days of account opening.

Something important to remember about this account: The monthly maintenance fee is waived for those under 24, but once you turn 24, the $15 will start being assessed.

TD Savings Account Promotions

TD Signature Savings and TD Simple Savings – earn a $200 cash bonus

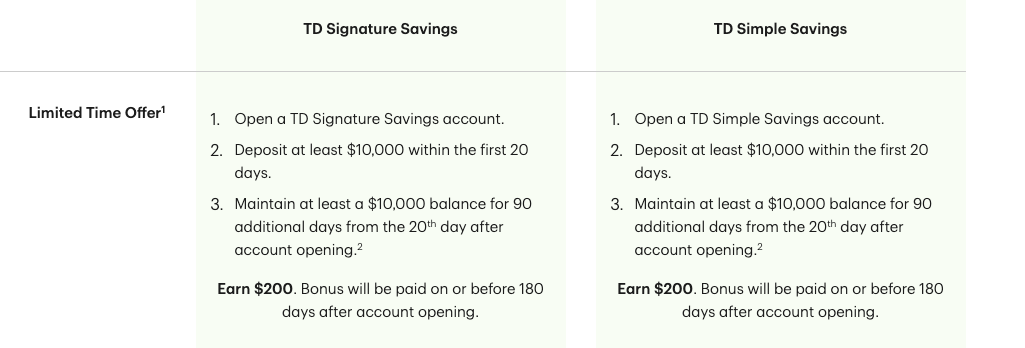

Through March 31, 2025, you can earn a $200 cash bonus when you sign up for a TD Bank Signature Savings or TD Simple Savings account and complete the required activities.

To earn your bonus, complete the following requirements.

- Sign up for a new TD Signature Savings or TD Simple Savings account.

- Deposit at least $10,000 into your new account within the first 20 days.

- Maintain at least a $10,000 balance for 90 days after your 20th day.

Once you complete all the requirements, the $200 bonus will be paid within 180 days of account opening.

TD Savings Account features

Monthly maintenance fee: The TD Signature Savings account has a $15 monthly maintenance fee, which can be waived in two different ways.

- Maintain a minimum monthly balance of at least $10,000.

- Connect either a TD Beyond checking account or a TD Complete checking account.

The TD Simple Savings account has a $5 monthly maintenance fee, but the fee can be waived in several ways.

- Maintain a minimum daily balance of at least $300 during the statement cycle.

- Link a TD Beyond checking account or TD Complete checking account.

- You are under 18 years old or over 62 years old.

Interest: The TD Signature Savings has a tiered interest rate based on your account balance, while the TD Simple Savings account has a flat interest rate.

TD Credit Card Promotions

TD Bank Cash Card – $150 cash back

Anyone looking for a cashback credit card should consider the TD Bank Cash Card. After completing the requirements, you could earn $150 cashback for a limited time.

To earn your cashback, complete the following requirements:

- Sign up for a new TD Bank Cash Card.

- Spend at least $1,000 on your new card within the first 90 days from account to opening.

Features of the TD Bank cash card

With this cashback card, you will earn the following cashback rewards:

- 3% cash back at restaurants

- 2% cash back on groceries

- 1% cash back on all other purchases

How to open a TD Bank account

Opening a TD Bank account is simple and should only take a few minutes. You’ll need to provide your basic information, including your name, Social Security number, government-issued ID, and address.

You’ll then need to select the type of bank account you want to open. This could be a checking account, a savings account, an investment account, or a credit card.

It’s that simple. But don’t forget, before earning your TD Bank welcome bonus, you’ll need to complete the necessary requirements.

How Do These TD Bank Bonuses Compare?

TD Bank offers a significant number of account bonuses compared to most other banks. Unfortunately, because TD Bank is regional, they’re only available to someone living in a state with a branch location.

If you are looking for a new checking account and don’t live in an eligible state, consider one of these other bank promotions.

U.S Bank Smartly® Checking

Earn up to a $450 cash bonus when you complete qualifying activities.

Chase Total Checking

Earn a $300 bonus when you open a Chase Total Checking account and set up qualifying direct deposits.

BMO Smart Advantage Checking

Earn a $350 bonus when you sign up for a BMO Smart Advantage checking account and complete qualifying activities.

Frequently Asked Questions About TD Bank Promotions

How to Get $300 From TD Bank?

When you sign up for a TD Bank Beyond checking account and complete the requirements, you can earn $300.

Which TD Bank personal savings account should I open?

TD Bank offers two different personal savings accounts: the TD Signature savings account and the Simple savings account. The Signature Savings account has a tiered APY based on your account balance, ranging from 0.01% to 4.00%. The Simple Savings account has a flat APY based on your location.

Who is eligible for a TD Bank bonus?

You’re eligible for a TD Bank bonus if you live in Connecticut, D.C., Delaware, Florida, Massachusetts, Maryland, Maine, North Carolina, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, South Carolina, Virginia and Vermont.

How long does it take to get a bonus from TD Bank?

In most situations, you will receive your bonus at least 180 days from the day you signed up, as long as you’ve completed the requirements.