The way you manage your finances today has a major impact on your future. When you’re ready to purchase a house, financial management plays a role in whether you’ll qualify for loans.

The way you manage your finances today has a major impact on your future. When you’re ready to purchase a house, financial management plays a role in whether you’ll qualify for loans.

Unfortunately, some people put personal finances on the back burner – which is a huge mistake. Life happens. When you least expect it, certain situations can put a kink in your money. But you can prepare – whether it’s getting a no exam life insurance policy or boosting your savings account at your local credit union.

So, how does your planning compare? Even if you’re not doing a bad job, there is always room for improvement. Learn how to identify things that can shake your finances, and then prepare accordingly.

Overspending

You work hard and undoubtedly want to see the fruits of your labor. This is totally normal. But at the same time, you owe it to yourself to recognize financial limitations.

Too often, people spend more than they earn, which often triggers debt and financial problems. By living within your means and establishing a budget on a weekly or monthly basis, you can avoid most of the headaches that come from overspending.

But how can you recognize a spending problem? Ask yourself, how much do I owe on credit cards? Am I an emotional spender? How much do I have in my savings account? The answers to these questions can reveal a lot about your spending habits. Your spending may not be out-of-control yet, but if you don’t get a handle on your shopping, you might create financial problems for yourself.

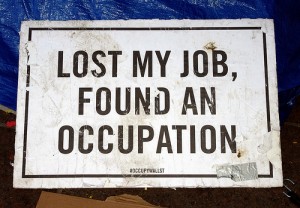

Job Loss

Being called into your supervisor’s office and receiving a pink slip is probably the worst feeling in the world, especially if you have a family and a lot of obligations. Being a top performer or seniority doesn’t always protect you from a job loss. Sometimes, the job loss comes out of nowhere.

However, there are ways to prepare for this unfortunate event. Rather than view yourself as irreplaceable, always recognize the possibility of a layoff. How can you demonstrate your readiness? Simple – use this time to beef up your savings account.

Even if you qualify for unemployment compensation, benefits typically do not exceed $400 a week. You might stay financially afloat if your spouse works, but if you’re on your own, or if your family depends heavily on your salary, a savings account can help weather the storm.

Death

The importance of life insurance cannot be stressed enough. Do you have a family? Do you have debt? If you answered yes to either question, you need a life insurance policy.

The type of coverage and the amount of coverage really depends on your personal situation. For example, the head of a household may require more coverage than a single person with no dependents. Don’t think life insurance is out the question if you have a pre-existing medical condition. A simplified life insurance guide from SILI can help you find the coverage you need, at a cost you can afford.

Preparing for the worst is a key element in financial planning. The sooner you start, the better off you’ll be. Think of how confident you’ll feel knowing you’ve done everything possible to protect yourself and family.

Luckily I don’t have debt or any dependents so i’ve been able to hold off on purchasing life insurance. Thank goodness, the last thing I need is another expense.

Life insurance is something that we plan on looking into soon. We will definitely need it when we have children.

Job loss can be a huge blow to your finances. That’s why we have a solid emergency fund we can rely on just in case.

Like Lance noted, job loss is probably the one of the three most likely to wreak havoc on our finances in the coming years. It’s the one on the list I worry most about.

I think these days it’s a worry of a lot of people.

Great, straight forward guidance on a topic that everyone should embrace.