Truist Bank might not be a household name quite yet, but they’ve quickly become the eighth largest bank in the United States. Formed in 2019 after the merger between BB&T and SunTrust, they have more than 2,000 branch locations in 17 states and Washington DC.

Truist Checking Account Bonus – Personal

Truist Bank One Checking – $400 cash bonus

Through April 30, 2025, you can earn a $400 bonus when you open a new Truist Bank One Checking account and complete the requirements within 90 days.

How to get the bonus

- Sign up for a new Truist One personal checking account with coupon code AFL2425TR1400 and make a deposit of at least $50 at account opening.

- Within 90 days of account opening, set up at least one qualifying direct deposit of at least $500 and complete a minimum of 15 debit card transactions.

Once you’ve completed the requirements, your bonus will be deposited into your account within four weeks.

To get the bonus, you must sign up for an account online or in a branch, but it’s only available to those living in the following states:

Alabama, Arkansas, Florida, Georgia, Indiana, Kentucky, Maryland, Mississippi, North Carolina, New Jersey, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, West Virginia, and Washington, D.C.

If you don’t live in one of these states, we have a comprehensive list of other bank bonuses that might be a better fit.

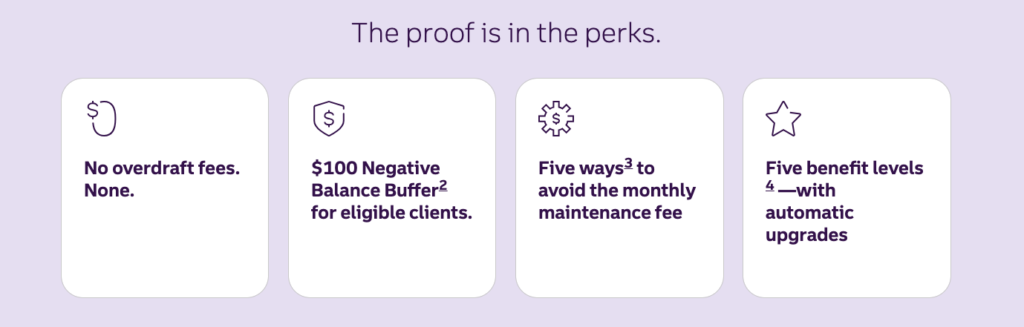

The Truist One Checking account has a $12 monthly fee, which can be waived five different ways.

- You’re a student under 25 years old.

- Have at least $500 in direct deposits during the month.

- Have a minimum balance of at least $500 combined in all your Truist accounts (banking and investment).

- Have a personal Truist credit card or consumer loan.

- Link a Truist small business checking account.

Stay Updated on the Latest Bank and Credit Card Bonuses!

Want to earn extra cash? Join thousands of savvy readers who get exclusive updates on the best bank and credit card bonuses delivered straight to their inbox!

I hate spam as much as you do. We’ll never sell your information to anyone.

Truist Business Checking Account Bonus

Truist Small Business Checking – $400 cash bonus

Through March 31, 2025, you can earn a $400 bonus when you sign up for a new Truist Simple Business checking or Dynamic Business Checking account and complete the required activities.

How to get the bonus:

- Sign up for a Truist simple business checking or dynamic business checking account using coupon code SB24Q4BIZAFL.

- Make qualifying deposits of at least $2,000 within the first 30 days.

- Within the first 30 days, you must also sign up for online banking and log into your account.

To be eligible for this bonus, you must not be a current Truist business checking account customer or have closed an account in the past 180 days.

This account is available to any businesses located in the following states: Alabama, Arkansas, Florida, Georgia, Indiana, Kentucky, Maryland, Mississippi, North Carolina, New Jersey, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, West Virginia, and Washington, D.C.

Features of a Truist Simple Business Checking Account

- No monthly maintenance fee

- 50 monthly transactions

- $2,000 in cash processing each month

Features of a Truist Dynamic Business Checking Account

- $20 monthly maintenance fee (waived with an average relationship balance of $5,000).

- 500 monthly transactions

- $25,000 in cash processing each month

Locating a Truist Bank Branch Location

Most Truist Bank locations are in the Eastern part of the US. However, there are some locations as far west as Texas. To find a Truist Bank location nearest you, use the bank locator feature on their website.

Truist Bank Routing Number

If you’re looking to set up direct deposits with your new account, you’ll need the Truist Bank routing number, which for many people is 061000104.

How Do These Truist Bank Promotions Compare?

Truist Bank has some great promotions available for personal checking accounts and business checking accounts. But because they’re not a nationwide bank, they may not be available to you. Here are a few other promotions you can consider instead. You’ll also want to make sure you check out the current Truist CD rates.

U.S Bank Smartly® Checking

Earn up to a $450 cash bonus when you complete qualifying activities.

Chase Total Checking

Earn a $300 bonus when you open a Chase Total Checking account and set up qualifying direct deposits.

BMO Smart Advantage Checking

Earn a $350 bonus when you sign up for a BMO Smart Advantage checking account and complete qualifying activities.

Frequently Asked Questions

Are Truist Bank promotions taxable?

Yes, the bonus you receive from Truist Bank is taxable. You will receive a Form 1099-INT in January.

Does Truist Bank offer bonuses to current customers?

No, Truist Bank only offers promotions and bonuses to new customers or customers who have not had an account open in the past 180 days.