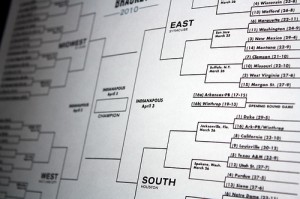

With the hint of spring in the air, our thoughts start turning to brackets, Cinderella stories, and the elusive sure thing. Yes, it’s time once again for March Madness.

With the hint of spring in the air, our thoughts start turning to brackets, Cinderella stories, and the elusive sure thing. Yes, it’s time once again for March Madness.

If you’re like 20% of workers, you’re going to take part in an office March Madness betting pool this year. And while you have the potential to win some money while watching your favorite college basketball teams, you also need to remember that there are legal and tax implications to betting on an office pool. Here’s what you need to know about taking part in a March Madness:

Office Pools Are Illegal

It may surprise you to learn that betting in an office pool for something as innocuous as March Madness is against the law. Unless you live in Nevada, betting on college sports is illegal.

However, it should be fairly clear that there are few sting operations set up to bust illegal March Madness workplace gambling—so there’s no need for you to keep looking over your shoulder for the FBI while you fill out your brackets.

But, the higher the stakes in an office pool, the more likely it is that it could potentially cause some trouble for an office.

In particular, it is the employer who would face some serious consequences if the authorities were ever to get involved. This is especially true if the employer also owns the property where the workplace is located, since the owner of a site where illegal gambling takes place is considered just as liable as the organizers and the gamblers, even if the owner has no involvement whatsoever.

That being said, considering the enormous camaraderie that such betting pools can create in a workplace, few employers are willing to be the party pooper who shuts things down. According to LegalZoom, there are a few things offices can do to reduce liability while still keeping the fun: “If you do decide to organize or allow an office pool, keep the stakes low and separate gambling and work. Avoid online brackets and keep your pool on paper.”

The Taxman Wants a Bite of Your Winnings, Even if They’re Illegal

It may seem to be a paradox, but even though your winnings from March Madness betting are not condoned by the government (and could even potentially land you in hot water), the IRS still wants its portion. That’s because any additional form of income, including (illegal) gambling wins, must be reported on Form 1040 to Uncle Sam.

If you are taking part in a legal betting operation and win, you may receive a Form W-2G from the organization awarding you the prize. In order to receive this form, you need to win $600 or more, or your winnings need to equal more than 300 times your wager.

In general, your winnings from a casual office pool will fly under the radar. However, if your workplace has high-stakes March Madness betting, it would be prudent to report that income and pay your taxes on it. You would hate to face an audit down the road all because of the $6,000 you won by betting on a dark horse.

The Bottom Line

Dealing with the rules and regulations of illegal gambling can be enough to make you rethink your excitement over filling in the brackets. However, provided your betting pool stays low-key and low-stakes, you don’t really have a reason to worry.

After all, this is supposed to be harmless fun.

Have never bet on March Madness but I love filing out those brackets! I’ve never gotten close to having all my picks right though. Too many unpredictable upsets but that’s what makes it the best few weeks on the yearly sports calendar.

the opening four days are easy some of the best days of the year. Nothing but great basketball.

I would like to see the day the IRS comes after someone for winning a March Madness pool and not reporting it =)

Would be quite the story huh? Haha